Articles

Editor’s Picks

Industry News

2018 In Review: Learning Management Systems

By Henry Kronk

December 12, 2018

For the past several years, venture capital, along with some public incentives, have surged into edtech, spurring advances and development that continually seek to improve education worldwide through technology. 2018 was no different. In the learning management system (LMS) market, trends from previous years by and large continued, and certain players passed important milestones.

While other edtech sub markets–such as online test prep, remote tutoring, and textbook and course supplement publishing–have seen strong competition eked out by numerous different players, the barriers of entry in the LMS arena remain demanding and insurmountable to most.

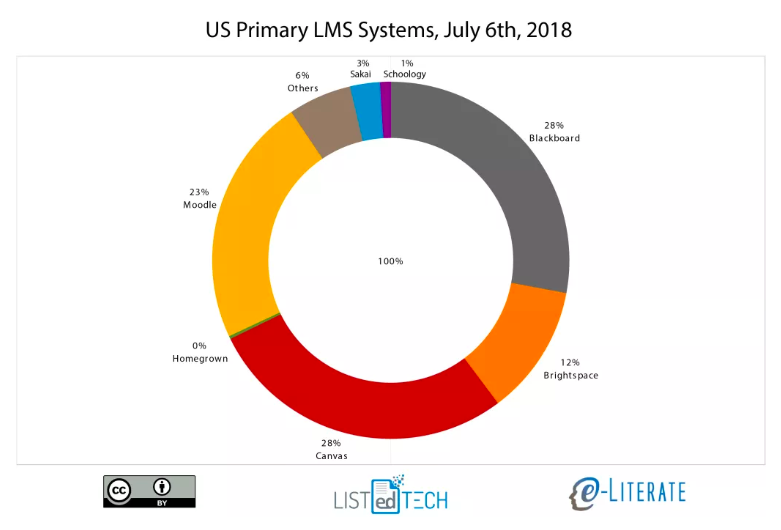

Blackboard vs. Canvas by Instructure

Since Canvas by Instructure began to gain traction among U.S. institutions around 2013, it has steadily added new clients, eating mostly into Blackboard’s market dominance as legacy contracts signed in the aughts have begun to expire. According to the e-Literate blog run by Michael Feldstein and Phil Hill, which monitors the LMS market among many other things, Canvas drew virtually even with Blackboard in terms of North American market share as of July 6. It is likely they have since surpassed the long-time proprietary LMS giant.

While Instructure has continued to snap up both academic and corporate clients (with their enterprise LMS Bridge and other products), their growth has come at a significant cost and the company has yet to net a profit. As of their latest Q3 report, they had grossed over $10 million more than they had year over year in 2017, but their net GAAP loss was virtually the same at $11.47 million. Since Instructure went public, they have reported net losses every year. Their latest funding round (Series E at $40 million) came back in 2015. While their stock took off this year (as did that of many U.S.-based companies), growing from below $35 per share in early January to nearly $50 in August, it has since corrected to the mid- to high-30s. It remains to be seen how long Instructure can sustain these losses.

Moodle Parts Ways with Blackboard

Moodle says they dumped their former partner. Blackboard had a different take. Regardless of who is coming out of this with their head higher, the split likely won’t change things too drastically down the road. It was a strange match from the start when Blackboard, a proprietary LMS vendor, acquired the open LMS services and support arm of Moodle, Moodlerooms Inc. and NetSpot (the Australian counterpart) in 2012 and entered into a more general partnership.

Moodle remains the world’s most-used LMS, and they run their company with a healthy dose of positive ideology. The group has had investors knocking at the door for years, and they’ve remained highly selective of which investments they’ll accept and what amount of control they’ll hand over.

Meanwhile …

Blackboard Reports Strong Growth with their Open-Source LMS Services

While far less significant in terms of volume and gross profits, Blackboard made an astonishing announcement in September. Remember that open LMS services arm of Moodle (Moodlerooms and NetSpot) that they acquired back in 2012? Well, that division of Blackboard Inc., Blackboard Open LMS, is going gangbusters. According to a statement by Blackboard Chief Portfolio Officer Kathy Viera, “Over the past year, we’ve seen a 20% growth in Blackboard Open LMS clients and [we] are adding more than one new client per business day. We have a vested interest in continuing to contribute code and features back to the open-source community—and working to move the community forward together.”

The news is shocking considering how Blackboard has stuck to its proprietary guns for most of its 21-year history. During the dotcom crash in the late ’90s, Blackboard managed to weather the storm and found itself the apex predator in the then-barren LMS ecosystem, which persisted throughout most of the aughts. During that time, the company brought in profit from both LMS services and support along with licensing their proprietary software. Many viable competitors were acquired or sued out of existence. That didn’t change until Instructure (Canvas is open-sourced) began eating into their market share.

Considering the success of Canvas and the growth in Blackboard Open LMS, it seems that the model of open-source, cloud-based LMS model is here to stay. It turns out a lot of players can develop a really great LMS product, but success in the sector involves much more than that.

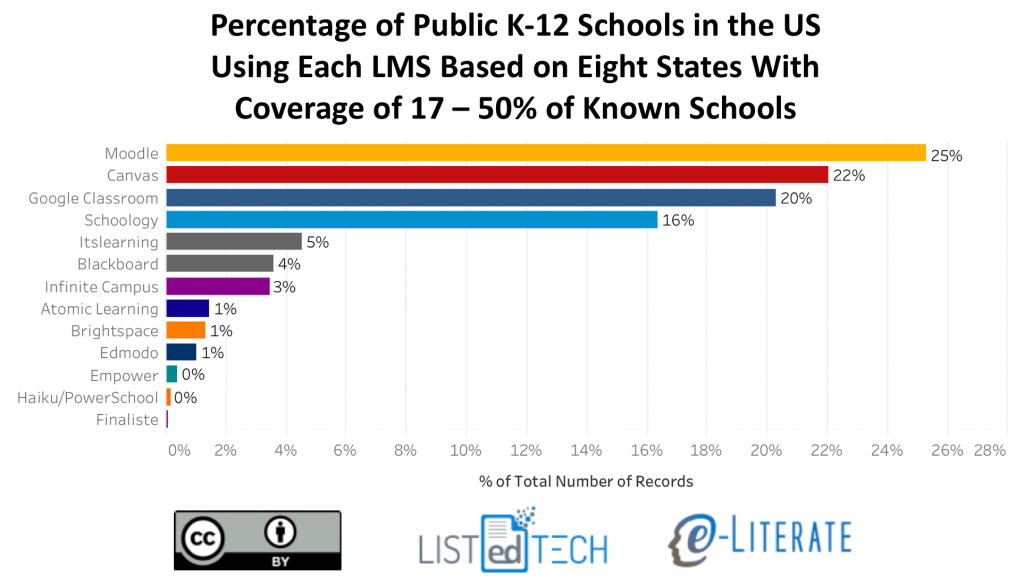

The K-12 Market

While more difficult to measure, most secondary and primary institutions in the United States and Canada now use LMSs. Moodle remains the top player with use by about a quarter of U.S. public schools, but Canvas is close behind at 22%. Next come two interesting players: Google Classroom (20%) and Schoology (16%).

Google Classroom is a part of Google’s G Suite for Education. As Michael Feldstein wrote in 2014:

“None of this argues that Google Classroom is an inferior tool – it is just not designed to replace the full-featured LMS. Remember that Google is a technology-vision company that is comfortable putting out new tools before they understand how the tools will be used. Google is also comfortable playing the long game, getting more and more instructors and faculty using, giving feedback, and pushing forward the new toolset. This process will take some time to play out – at least 2 or 3 years in my opinion before a full institutional LMS may be available. If Google like the direction Classroom usage is going.”

While Google has made a huge push into K-12 classrooms with their highly affordable Chromebooks and software, G Suite has also come under fire for its student data collection policies. It remains to be seen where their LMS will go.

Schoology marks another interesting player. The company focuses specifically on the K-12 market. As such, it is still miniscule in comparison to the big four international LMS companies (Moodle, Blackboard, Instructure, and Brightspace). But as the ancient Jewish proverb states, it matters not the height at which you begin climbing the ladder of life, but in which direction you travel.

Schoology has been moving up. In June, CEO Jeremy Freidman said they were on track for a record year.

“As the K-12 edtech market matures, school districts are looking toward technology to consolidate communication and give teachers new ways to educate students. We are seeing the Schoology platform successfully used in classrooms across all grade levels and having a large, positive impact on students’ ability to learn and use the technology that they will depend on in their careers … We welcome these new schools and districts of all sizes into our diverse Schoology community of educators and are committed to working with them achieve amazing results for their students, teachers and parents.”

What About Brightspace?

While Brightspace by D2L has been adopted by roughly 12% of U.S. institutions of higher education, the company also counts hundreds of international clients and has offices in Singapore, Australia, Europe, Brazil, and the United States, not to mention its home base in Kitchener, Ontario. D2L is a private company with a lower profile than other big LMS players, and there is much we don’t know about their operations.

Still, the company released two new versions of Brightspace this year (Emerald and Magenta) and continues to be an LMS force around the world.

While the LMS market is still dominated by a few players, increasing competition continues to drive growth and innovation. 2019 should prove to be another exciting year.

Featured Image: Steven Lelham, Unsplash.

No Comments