Editor’s Picks

Industry News

Blackboard Reports Surprisingly Strong Growth Among Open-Source Clients

By Henry Kronk

September 20, 2018

Blackboard, once the world’s largest proprietary learning management system (LMS) provider, announced on Wednesday that, following its split with Moodle, the company would be rebranding its open source SaaS service provider Moodlerooms as Blackboard Open LMS. At the tail end of the release, Blackboard Chief Portfolio Officer Kathy Vieira, said something astonishing:

“This rebrand marks a new chapter for our open-source SaaS product, where we’re realigning the solution with our overall mission to meet the evolving needs of institutions and their learners. Over the past year, we’ve seen a 20% growth in Blackboard Open LMS clients and are adding more than one new client per business day. We have a vested interest in continuing to contribute code and features back to the open-source community—and working to move the community forward together.”

Wait, What?

In other words, the company that made it big in the post-dotcom crash desert selling their proprietary LMS solutions is now gaining market share on the open-source end of the spectrum. Profit comes in by taking care of the heavy lifting involved in deploying their open-source LMS instead of licensing the product itself.

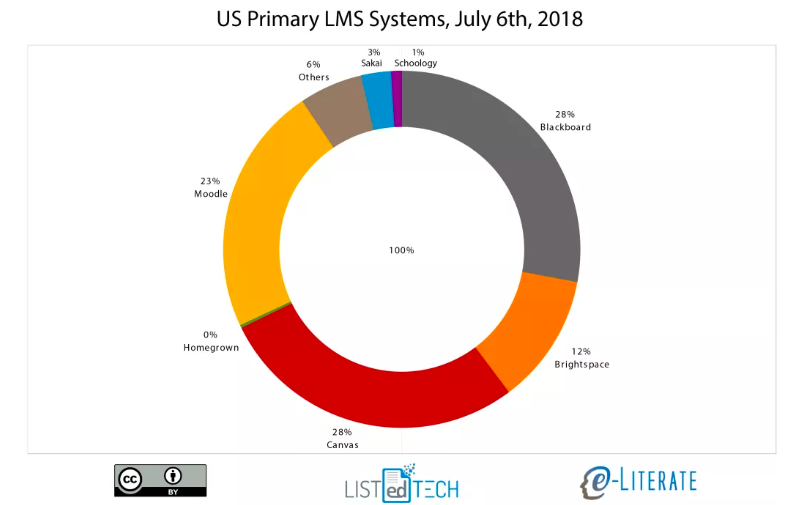

Earlier this summer, Canvas by Instructure officially edged out Blackboard Learn as the most widely used LMS in the U.S., as reported by E-Literate. The former beat out the latter by a margin of 2 institution installs, with the scoreboard reading Blackboard: 1,216 Canvas: 1,218. That statistically gave both companies a market share of 28%.

Blackboard’s market share once stood at 70% when it acquired WebCT in 2006. E-Literate’s Michael Feldstein writes how, at the time, “A few platforms, most of which no longer exist, were vying with “homegrown” to become the Dr. Pepper of the LMS market at the time that the Coke acquired the Pepsi.”

For years, Blackboard dominated by acquiring their competition, like WebCT and later ANGEL. When that didn’t work, they aggressively sued other companies into submission.

These strongman tactics no longer translate into a viable survival strategy.

Once public, Blackboard was brought private when it was acquired by Providence Equity Partners. The public, therefore, does not have access to any juicy details of business goings-on that can be found in 10Ks, quarterly reports, or investor relations documents.

But it isn’t difficult to tell which way the wind is blowing. Campus newspapers across the U.S. almost unequivocally describe how, following the end of their contract with Blackboard, they will be switching to Canvas, Moodle, Brightspace, or someone else. In the past month, readers have heard it from Cornell, the College of St. Rose, Washington University, and others.

These stories have appeared perennially for the past few years.

So Blackboard is bleeding proprietary institutional use, but the volume and rate of blood loss is unclear. Their growth in the open-source sector, however, might be more than a band-aid.

Blackboard and Moodle Part Ways

The news follows the breakup between Blackboard and Moodle earlier this summer, which Inside Higher Ed described as “messy.” At one time, it appeared that Moodle, a free, open-source LMS provider, would stand as Blackboard’s most viable competitor. In 2012, the company struck a partnership with the organization and acquired their service arms Moodlerooms and NetSpot, the Australian counterpart.

It was apparently a wise investment on Blackboard’s part. We truly live in interesting times. And if the company continues to sign a Blackboard Open LMS client on a daily basis, Canvas might not remain on top for long.

Featured Image: Wikimedia Commons.

No Comments