Articles

How the OPM Market Is Slowly Shifting Out of the Profit-Sharing Model

By Henry Kronk

April 04, 2018

It used to be that, if a university wanted to create online versions of their in-person courses, programs, and degrees, they would have to build it themselves. For most institutions, this barrier of entry was insurmountable. Taking into account the internal politics and power dynamics of administrators, allocating funding, and simply having the tech know-how made creating an online program very difficult. But that hasn’t been the case for years. Now, online program management (OPM) companies can take care of everything.

These third parties act as Jacks of all trades when it comes to online college courses. They’ll handle the site, portal, or platform design and they’ll host it themselves (or more probably, hire a cloud provider). They’ll perform marketing and recruitment services, manage and track enrollment, help with course/curriculum design, and, among many other things, provide IT support.

That sounds like a no-brainer for universities looking to expand access to their education and move online. There’s only one problem: it’s really expensive.

The Typical OPM Cut

Of course, it all depends on what you need from your OPM. But as Phill Hill, co-creator of e-Literate writes in a recent post, those high costs are going to make for a less-than-ideal contract.

According to Hill, the way that most OPMs mitigate the challenge is through profit-sharing. The typical OPM contract requires universities to sign away anything from 40%-60% of their profit from online courses.

Any scalable online program will need multiple rounds of investments before they begin to break even. As Hill writes, “Rather than requiring the institution to spend sizable up-front money without a guarantee of repayment, revenue-sharing OPM vendors provide this financing themselves – which is in itself an expensive proposition. It often takes three to five years for an OPM company to become profitable for any online program, which is why they often require 10-year or even longer contracts.”

Any scalable online program will need multiple rounds of investments before they begin to break even. As Hill writes, “Rather than requiring the institution to spend sizable up-front money without a guarantee of repayment, revenue-sharing OPM vendors provide this financing themselves – which is in itself an expensive proposition. It often takes three to five years for an OPM company to become profitable for any online program, which is why they often require 10-year or even longer contracts.”

Bringing a course online requires some seriously heavy lifting. It’s no wonder that a university’s faculty often grate with or openly oppose their OPM. Both administrators and OPM managers have a clear incentive to cut costs anywhere possible.

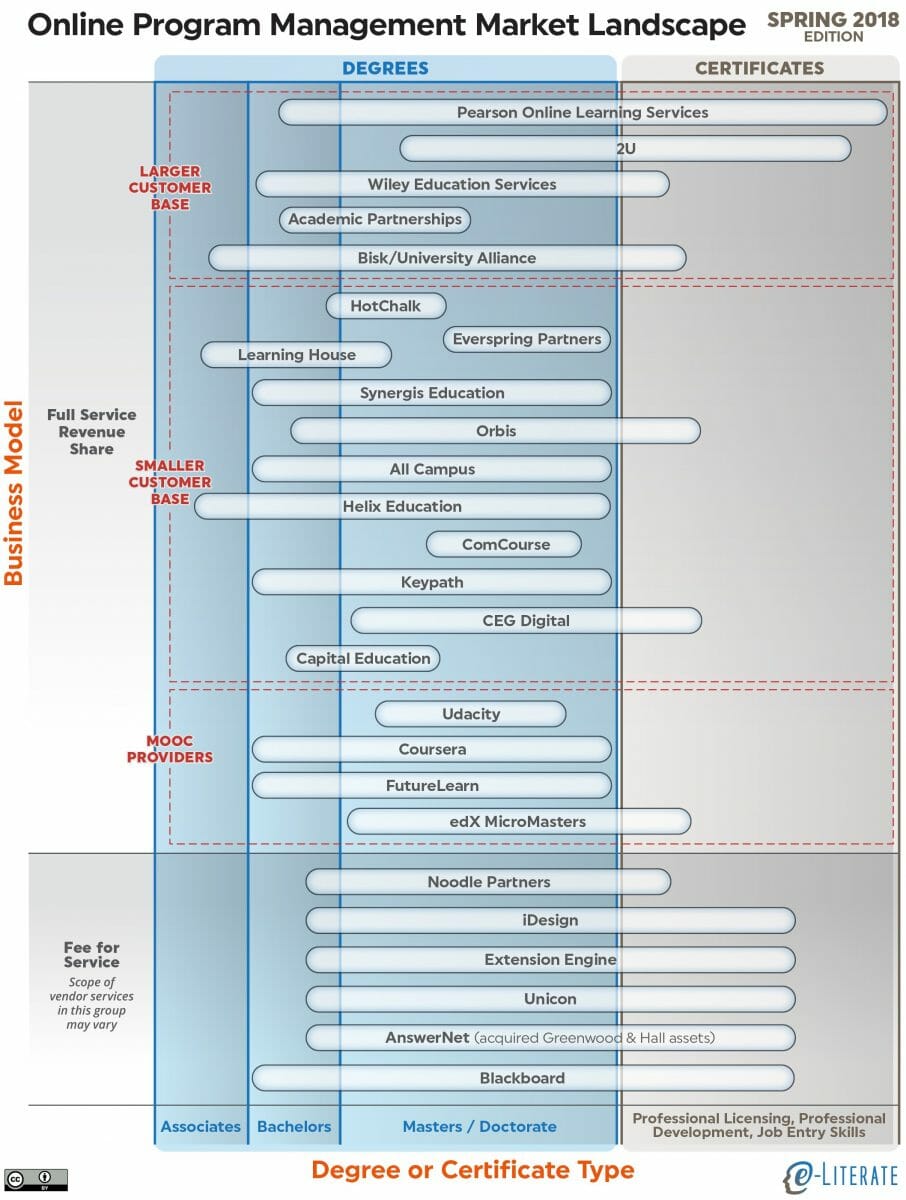

Hill has kept tabs on the OPM market for years. The field has slowly begun to change of late, and he has also rethought the role that some companies play. To keep track of where things are, he has created an infographic on the market.

Recent Developments in the OPM Market

To begin, some OPMs have begun to offer single services without a full bundle and a lengthy profit-sharing contract. This allows universities to make full use of the resources that lay at hand and fill in the gaps at a much lower cost. This trend is only just catching on, but it’s providing a much needed second option to the high stakes cost-sharing model.

Second, Hill has begun to consider MOOC providers as OPMs. It makes sense. MOOC providers have the technological infrastructure (and often marketing, enrollment, and support frameworks as well). Yes, most of these companies will still charge a demanding rate, but their existing infrastructure should bring OPM costs down, especially if academic departments don’t require much help in creating their online curricula.

Third, Hill includes Blackboard, a company known for its learning management system (LMS) as well. Specifically, Blackboard sits in the category of companies that offer services for a fee (not the cost-sharing alternative). While Blackboard has been steadily losing market share to Instructure’s Canvas, their involvement in the OPM field makes their products more attractive than eLearning Inside News’ previous analyses.

All this goes to show that the various subsectors of education technology and eLearning are hardly well-defined. One company might operate in several different spaces and maintain fairly unique offerings. While, in the past few years, the OPM, LMS, and MOOC spaces have grown crowded, many companies involved in these fields can still prove to be a better fit for the specific needs of an institution than the company that maintains the biggest market share. Year-over-year growth, SEC filings, valuation, or anything else you can find on a quarterly report might be moot points if your institution has specific needs when moving your courses online.

No Comments